Popular Economics Weekly

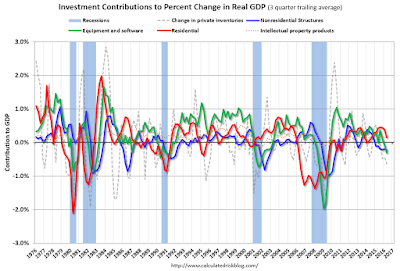

There is a reason second quarter Gross Domestic Product growth was so weak—up just 1.2 percent, after 0.9 and 0.8 percent upticks in the last 2 quarters. Pundits attributed it to the lack of capital expenditures, whereas consumer spending increased some 4.2 percent, which should mean a 3 percent annual growth rate, at least. But neither the private nor public sectors are investing much in future growth.

“The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE) and exports that were partly offset by negative contributions from private inventory investment, nonresidential fixed investment, residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased,” said the BEA announcement of last Friday.

Graph: Calculated Risk

Though Personal consumption expenditures (PCE) were up 4.2 percent vs. 1.6 percent in Q1, said the report, residential investment (RI) decreased at a 6.1 percent pace. Equipment investment also decreased at a 3.5 percent annualized rate, and investment in non-residential structures (i.e., commercial/industrial) decreased at a 7.9 percent pace due to the recent decline in oil prices.

It is also due to the lack of government spending. Public spending on such as infrastructure would employ millions and improve productivity, something both Presidential candidates say they want. Private sector growth should then follow, as even public works projects have to be built by private sector workers in private sector companies.

That is perhaps the major reason private sector corporations are investing less. There’s a lack of confidence in the future, what with Brexit maybe damaging future EU growth, and a certain Republican Presidential candidate threatening to blow up the US economy with massive tax cuts for the wealthiest, a trade war with the rest of the world, and no minimum wage increase.

Economist Dean Baker has said many times there is no secret to expanding employment and growth: “The point here is a simple one, we know how to get out a depression. It's called "spending money." We got out of the last Great Depression by spending lots of money on fighting World War II. But guess what, the economy doesn't care what we spend money on, it responds in the same way. So if we instead (of bailing out the banks with TARP) had spent 20 percent of GDP on building highways, housing, hospitals, and providing education and child care it also would have led to double-digit economic growth and below 3.0 percent unemployment.”The consumer is healthy with the 4.2 percent spending increase, though consumers are saving much more these days, a result of growing incomes. Personal saving was $763.1 billion in the second quarter, compared with $847.8 billion in the first (revised). The personal saving rate -- personal saving as a percentage of disposable personal income -- was 5.5 percent in the second quarter, compared with 6.1 percent in the first, though it just dropped to 5.3 percent in this latest month.

Harlan Green © 2016

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment