The Mortgage Corner

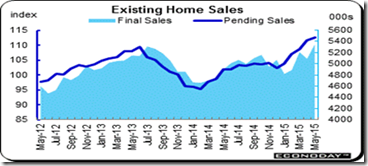

Pending home sales continued to rise in May and are now at their highest level in over nine years, according to the National Association of Realtors. Gains in the Northeast and West were offset by small decreases in the Midwest and South. This is why we expect both existing and new-home sales to be the best since 2006 at the height of the housing bubble.

And mortgage activity is soaring, thanks to ultra-low interest rates, with total mortgage origination balances reaching $466 billion in the first quarter -- nearly a 75 percent increase from the same time a year ago, according to the Equifax National Consumer Credit Trends Report.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, climbed 0.9 percent to 112.6 in May and is now 10.4 percent above May 2014. The index has now increased year-over-year for nine consecutive months and is at its highest level since April 2006.

Graph: Econoday

Pending sales were strongest in the West, up 2.2 percent in May for a 13.0 percent year-on-year gain. Pending sales in the South, up 10.6 percent year-on-year, have also been strong though the region though lower by 0.8 percent in the latest month. The Midwest was down 0.6 percent for a year-on-year plus 7.8 percent, but were up sharply in the Northeast where housing came back strongly from the severe winter, up 6.3 percent in this report for a year-on-year again of 10.6 percent.

NAR chief economist Lawrence Yun says contract activity rose again in May for the fifth straight month, increasing the likelihood that home sales are off to their best year since the downturn. "The steady pace of solid job creation seen now for over a year has given the housing market a boost this spring," said Yun. "It's very encouraging to now see a broad based recovery with all four major regions showing solid gains from a year ago and new home sales also coming alive."

Equifax said the bulk of mortgage growth has been to first mortgages, which zoomed nearly 80 percent compared to the first quarter of 2014 to $430 billion. The number of first mortgages originated in the first three months of the year was 1.78 million -- a 55 percent increase over the same time a year ago and 14 percent higher than in the fourth quarter of 2014. Originations of home equity lines of credit (HELOCs) rose 30 percent to $30.9 billion and new home equity installment loans climbed 13.6 percent to $5.0 billion.

- Average first-lien mortgage loan amounts rose to $232,547 in March, an 11.5% increase over March 2014;

- The number of first mortgages originated in the first three months of the year was 1.78 million, a 54.9% increase over the same time a year ago and 13.6% higher than in the fourth quarter of 2014;

- The share of first mortgage accounts originated in the first quarter that went to consumers with an Equifax Risk Score below 620 (generally considered subprime) was 4.5%;

- 3.1% of newly originated balances in the first quarter went to borrowers with subprime credit scores. For the same time a year ago, the share was 3.5%; and

- The average loan amount for a first mortgage originated to a borrower with a subprime credit score in March 2015 was $152,260, up 9.9% from March 2014.

"The drop in mortgage rates that began in the fourth quarter of last year kicked off a refinance boomlet that accelerated in the first quarter, as rates fell further, averaging just 3.7 percent for the first three months of this year," said Amy Crews Cutts, Chief Economist at Equifax. "While rates have recently reversed that trend and are back up to about 4 percent, they remain extremely low historically. These rates, coupled with a housing market that is showing signs of vigor, should carry the mortgage business over the summer."

So we are seeing the housing sector back to normal growth. Existing-home sales also rose 5.1 percent in May to a 5.35 million annual rate. Home sales were plus 9.2 percent which, outside of the March 11.9 percent, is the strongest rate in nearly two years. And prices are rising, up 7.9 percent year-on-year at a median $228,700.

But, "Housing affordability remains a pressing issue with home-price growth increasing around four times the pace of wages," adds Yun. "Without meaningful gains in new and existing supply, there's no question the goalpost will move further away for many renters wanting to become homeowners."

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment