Financial FAQs

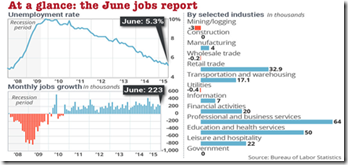

Should we push back the first Fed rate hike to the presidential election year of 2016, because of June's softer-than-expected employment report? Nonfarm payroll growth came in at 223,000 vs expectations for 230,000 and above. It included downward revisions totaling 60,000 to the two prior months (May revised to 254,000 from 280,000 and April to 187,000 from 221,000), said the Bureau of Labor Statistics report.

I doubt the Fed will wait that long, as the most recent economic data shows boom times—from rising home prices, as well as construction spending, and manufacturing activity on the rise again. This could be a temporary softness, in other words, as the US economy approaches full employment. And it is a good jobs report, given all the uncertainties affecting economic growth these days.

Softness in payroll growth was combined with softness in wage pressures with average hourly earnings unchanged in the month and the year-on-year rate moving down to 2.0 percent from 2.3 percent. But that can be deceptive. Median household wages are now rising 3 percent, which means the income ‘bar’ for 50 percent of the families doing well is rising faster than inflation.

But there is still a lot of labor slack in our job market that Fed Chair Yellen has been talking so much about. This is most evidenced by part-timers who would rather work fulltime, according to the BLS. Their numbers are declining, from 6.65 million to 6.51 million in one month, but would still have to drop by one-third to return to the range that prevailed from the 1970s until the start of the Great Recession in this Calculated Risk graph.

And the labor force participation rate just declined to 62.6 percent, from its historical 67 percent in the Calculated Risk graph that dates from 1960. Economists are not sure of the reasons. It may be the working age population is not growing as fast—just 0.5 percent, instead of historical 1 percent, according to the latest census figures, but that shouldn’t affect the participation rate of those actually looking for work.

It could be that while more of the older workers are dropping out, the newest generation aged 16 to 35 years, now the largest segment, is just entering the work force. This is why the actual unemployment rate fell to 5.3 percent. More dropped out of the labor force (432,000 seasonally adjusted) than were newly employed, according to the household survey that also tracks the self-employed.

So look for a Fed rate increase before the end of 2015—but only one—maybe in September. That means 2016 might be a wild year, with both economic growth and politics dependent on so many factors—such as the dollar strength, inflation, the price of oil, the Eurozone, and even geopolitical uncertainty.

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment