Popular Economics Weekly

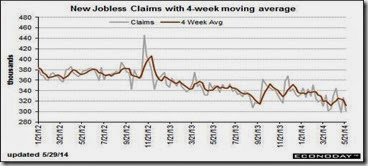

Jobless claims fell sharply in the May 24 week, down 27,000 to 300,000. The 4-week average is down a very sharp 11,250 to a new recovery low of 311,500. It should mean we will see a further drop in the May unemployment rate out this Friday from 6.3 percent to 6 percent or below. This is huge and could mean continuing debate on the wisdom of the Fed holding down short term interest rate into 2015, when the US might already be at full employment.

The conventional wisdom is that a rate in the 5 percent range means all that are looking for work should be able to find decent paying jobs. But because so many have dropped out of the workforce—some 2 million at last count—they aren’t included in the numbers. In fact, including those working part time or that have left the workforce but are still able to work, would boost the unemployment rate to some 11 percent.

Continuing claims are also down, falling 17,000 in lagging data for the May 17 week to a new recovery low of 2.631 million. The 4-week average is down 33,000 to 2.655 million, also a recovery low. The unemployment rate for insured workers, also at a recovery low, held steady at 2.0 percent.

The real reason the Labor Department’s unemployment rate isn’t accurate shows up best in the labor participation rate. The percentage of population working has dropped to the lowest level in more than 20 years.

The Labor Force Participation Rate (blue line in graph) was decreased in April to 62.8 percent. This is the percentage of the working age population in the labor force. The participation rate is well below the 66 percent to 67 percent rate that was normal since 1978, really, although a significant portion of the recent decline is due to demographics.

April’s nonfarm payrolls rose 288,000 jobs, and that is the number looked at by most economists. It is based on an Establishment survey of actual companies, whereas the unemployment rate is a much small telephone survey of workers, which therefore includes the self-employed.

So whether it’s due to more retiring workers, or a shrinking population of eligible workers, or getting the discouraged workers back to work, it’s going to be more difficult to achieve real full employment in this recovery. And that is why I am predicting we will have low interest rates and a housing market still in recovery mode for a long time to come.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment