Financial FAQs

Is the jobs recession finally over? It’s taken this long to bring employment back to pre-Great Recession levels. Overall employment is still slightly below the pre-recession peak (437 thousand fewer total jobs). But private employment is now above the pre-recession peak by 110 thousand and at a new all-time high.

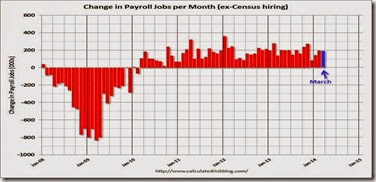

Total nonfarm payroll jobs rose 192,000 in March after a 197,000 boost in February and a 144,000 increase in January. The net revision for the prior two months was up 37,000. Expectations for March were for 206,000. Private payrolls gained 192,000, following an increase of 188,000 in February. Analysts projected 215,000 for March.

We can now see where many of the missing jobs remain—in governments. Although state governments added 8,000 net jobs in March, the federal government shed another 9,000 jobs, according to the just released Bureau of Labor Statistics report. Over the past year, employment in the federal government has fallen by 85,000, so we know the major reason we are barely back to the 2007 level of employment. In fact, some 700,000 state and federal jobs were lost during the Great Recession.

Unfortunately, political gridlock has caused so many essential government, or government-sponsored jobs to be lost. There shouldn’t be a debate over what federal, state and local government expenditures are necessary to maintain decent economic growth. Can one imagine what it would do to economic growth if the $2.2 trillion in deferred infrastructure building—in roads, bridges, electrical and energy distribution networks had been done, not to speak of the additional jobs created?

Or, instead of losing 300,000 teachers and the lost education opportunities to students, education spending had been expanded? A good comparison is with the GW Bush administration, when Republicans were in power. Then they were for much more government spending.

The public sector grew during GW Bush's term (up 1,748,000 jobs), but the public sector has declined since Obama took office (down 718,000 jobs). These job losses have mostly been at the state and local level, but they are still a significant drag on overall employment.

The private sector is the main jobs provider, of course. The single area that could provide the most bang for the buck is the construction industry. Since construction employment bottomed in January 2011, construction payrolls have increased by 532 thousand - but there are still 1.76 million fewer construction jobs now than at the peak in 2006, per an excellent analysis by Calculated Risk.

That also means the building-construction industry and all its ancillary services—such as mortgages, insurance, home furnishings—has much more room to grow. Private residential construction is returning to normal levels at last, but not public (which has fallen since ‘shovel-ready’ ARRA stimulus money ran out in 2010, which created or saved some 3 million jobs) and non-residential spending.

The bottom line is that all construction sectors have to improve to bring enough jobs back. These are mainly blue collar workers that lost badly during the Great Recession, due to the housing bubble. The good news is that professional and business services jobs grew double any of the other job categories in the March payroll survey.

Professional and business services added 57,000 jobs in March, in line with its average monthly gain of 56,000 over the prior 12 months. Within the industry, employment increased in March in temporary help services (+29,000), in computer systems design and related services (+6,000), and in architectural and engineering services (+5,000).

This should give a large boost to construction jobs this year and next.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment