Popular Economics Weekly

Consumer spending and future economic growth will depend on just how hard New Fed Governor Janet Yellen pushes the Federal Reserve Governors to maintain QE3 in 2014. She is a UC Berkeley economist interested more in creating jobs, and most of the Governors are bankers that would rather fight the fear of inflation than focus on keeping interest rates low enough to create those jobs. The December unemployment report was terrible, needless to say, with just 74,000 net nonfarm payroll jobs added.

It’s a contest between the Austerians (or Taperians), such as Fed Governors Lacker and Fisher that would end QE3 sooner vs. the Accomodators, such as Minneapolis Fed Governor Kacherlakota, which would like credit to remain easy until the unemployment rate drops below 6 percent—perhaps to 5.5 percent and closer to full employment. So how much will Dr. Yellen resist further tapering of QE3 is a big question to be answered at her first January FOMC meeting.

Taking out autos and gasoline, November consumer spending wasn’t that bad, but it could be all the holiday shopping, which is seasonal and could drop in January. So this is one indicator that will help decide what the Fed Governors do next with new Fed Governor Janet Yellen.

The latest retail sales report suggests a moderately healthy consumer sector-somewhat in contrast to the December employment report. Overall retail sales in December rose 0.2 percent, following an upwardly revised gain of 0.7 percent the month before (originally up 0.4 percent). Analysts forecast no change for the overall December figure.

As expected, autos tugged down sharply on sales. Motor vehicle & parts dropped 1.8 percent after a 1.9 percent increase in November. Excluding both autos and gasoline, sales advanced a healthy 0.6 percent in December, following a 0.3 percent gain in November. In the core, strength was seen in food & beverage stores, health & personal care, clothing, nonstore retailers, and food services & drinking places.

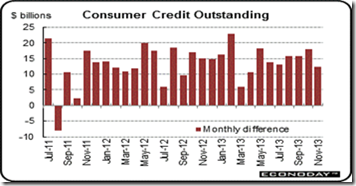

Consumers are also modestly optimistic about the economy, based on the expansion of consumer credit. (This could have a lot to do with those low interest rates, which include mortgage rates, and it is such low mortgage rates that have boosted housing prices.) Consumer credit rose $12.3 billion in November—a solid gain. Details showed a rare back-to-back gain for revolving credit, up a modest $0.5 billion but following a $4.0 billion gain in October which was the third largest gain of the whole recovery. The last time revolving credit rose 2 months in a row was back in January and February of last year.

So maybe we will have a Yellen rally, based on her well-publicized views on the importance of the labor side (vs. the owners, including corporations) in a strong economy—especially the 80 percent of wage and salary workers whose incomes haven’t risen at all with inflation since 2000.

Harlan Green © 2013

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment