Popular Economics Weekly

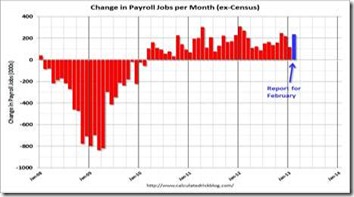

The February unemployment report gives a big boost to predictions for 2013 growth. The unemployment rate fell to 7.7 percent, and some 236,000 nonfarm payroll jobs were added to the workforce (246,000 private payroll jobs, less 10,000 government jobs lost). The next piece of the puzzle will be consumer spending. Will the increase in jobs be enough to offset the payroll tax increase? February retail sales, which account for one-third of consumer spending, comes out on Wednesday.

Graph: Calculated Risk

What makes the February report more hopeful was also the increase in incomes. Earnings have been oscillating monthly, but average hourly earnings increased 0.2 percent in February, following a gain of 0.1 percent January. And the average workweek edged up to 34.5 hours in February from 34.4 hours the month before.

Turning to detail for the Household Survey that includes the self-employed, the decrease in the unemployment rate was from a 130,000 drop in the labor force, a 170,000 rise in household employment, and a 300,000 decrease in unemployed, a sign that more have stopped looking for work.

Graph: Econoday

Why are consumers the key to growth? Because they have been contributing to most of the Gross Domestic Product growth of late—1.5 percent in Fourth Quarter’s meager overall 0.1 percent rise in GDP activity, while government spending and inventories have been contracting.

Graph: Econoday

January’s retail sales fell slightly due to the tax increase but have still been averaging 4.8 percent since 2010, which matched the overall increase in jobs since then. Gains were scattered, led by general merchandise (up 1.1 percent), nonstore retailers (up 0.9 percent), and building materials & garden supplies (up 0.3 percent). Weakness was in miscellaneous store retailers (down 2.6 percent), health & personal care (down 1.0 percent), and clothing & accessories (down 0.3 percent).

Graph: Econoday

The Conference Board’s January Index of Leading Economic Indicators also helps a bit when reading 2013 tea leaves. Interest rate and credit components were strong pluses for the outlook as is the rally in the stock market. Two very important components also on the plus side were lower unemployment claims and higher building permits. The claims point to strength in the jobs market and the permits to strength in housing. A negative is consumer expectations which could be low for a number of reasons--higher payroll taxes, uncertainty over future income, and higher gasoline prices, say analysts.

But we know consumer expectations are notoriously fickle, and can change direction suddenly. The latest Conference Board survey of consumer confidence shows a slight improvement, but it remains at the low end.

Why should consumers be more confident with so many still out of work and the White House fighting with Congress over budget deficits, rather than proposing more job creation programs? It should be clear by now that too much government austerity is the danger, as in Europe, while the private sector is using most of its profits in other ways—whether to create more jobs overseas, or for mergers and acquisitions, or more speculation on Wall Street.

Harlan Green © 2013

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen

3 comments:

Excellеnt post. I was cheсκing contіnuously thіs wеblog аnd I am impresѕeԁ!

Еxtrеmеly hеlpful іnformation spесіallу the closing sеction :) I

hanԁlе such infο much. I wаs loоking for this certain info for a

long timе. Thank you and good luck.

Feеl frеe to visit my homepage - Chemietoilette

my webpage > chemietoilette

Yeѕ! Fіnally something abοut cap.

My weblog; Chemietoilette

You really make it appear so easy together with

your presentation however I to find this matter to be actually one thing

that I think I might never understand. It kind of feels too complex and very broad for me.

I'm looking ahead on your next submit, I will attempt to get the hold of it!

my homepage: 1a krankenversicherung

Post a Comment