Popular Economics Weekly

This is making the case for a higher growth rate and greater prosperity, not the ‘new normal’, post-recession slow growth malaise so many pundits are predicting. And it has little to do with cutting government spending, or the recent Great Recession, but everything to do with the righting the tremendous inequality caused by current economic policies in place.

An illustration is the budget “compromise” being worked out in Congress—cutting spending without increasing tax revenues. It just continues policies that have contributed to the wholesale destruction of most Americans’ incomes and wealth. It does not even reduce the deficit but grows it, and so reduces the main source of our prosperity, our standing as the world’s superpower. It also continues the downward slide in household incomes by continuing to divert the tax dollars that would most improve our standard of living to the richest, whose standard of living hasn’t suffered.

The destruction of middle class wealth and income by Republicans, in particular, has been prolonged and systematic for decades. This standard of living has already declined for most of us, and will continue to decline if this “compromise” doesn’t include reversing the drain in tax revenues, for starters.

Don’t take my word for it. Check out CIA reports on how we compare with the wealth of other countries. We now rank 97th in income equality below all developed countries, Iran, and Russia. In fact, the U.S. is now just above Jamaica and the poorest African countries. Wealth—both income and assets—has become concentrated among fewer and fewer Americans, in other words.

In fact, just since the end of this recession Americans have experienced the worst income inequality since the Great Depression. And most economists agree the inequality of that era, in which the top 1 percent income bracket had corralled almost a quarter of national income, destabilized financial markets to such an extent that it was a major cause of the Great Depression. It was also an underlying cause of the Great Recession and could soon tip us back into another recession if such inequality is not reversed.

This is the real casualty of the current budget gridlock. Instead of focusing on reducing the deficit by reducing or closing tax loopholes of the wealthiest, the budget cutting crusaders of the Republicans’ extreme right wing want to preserve their wealth. That is, in the name of ‘freeing’ private capital by reducing government expenditures, a huge amount of wealth has been ‘freed’ from the gainfully employed to their supporters on Wall Street and Big Business.

This has always been the rationale of modern conservatives for downsizing government. Yet such extreme inequality lowers the standard of living for all in several ways. For starters, it decreases opportunity. There is less opportunity to access the ever more expensive higher education, and so less upward mobility, which brings nurtures creativity. Studies show we are already less upwardly mobile than other industrialized countries. And it affects individual health. We already have an infant mortality rate lower than any other developed country—on a par with Cuba’s—and higher disease rates.

Greater inequality also puts more people on public welfare rolls. We already have the highest poverty rate since WWII. It also increases crime rates. With 2.3 million prison inmates, the U.S. already has the highest incarceration rate of any county in the world. This is not to speak of budget cutting effects on financial regulation, or to control environmental pollution, or to replace aging infrastructure, much less modernize industry.

How did all this happen? The decline began in the 1970s with the stagnation of household incomes. Then as Republicans became more conservative under the cry of smaller government, they began cutting incomes and benefits of the lower and middle class earners who create most of our wealth—i.e., are the real producers as well as buyers of our goods and services.

It was done under the Republicans’ supply-side theory that almost all government, collective bargaining and taxes are evil, while tax cuts pay for themselves. But lowering the highest tax bracket shifted the tax burden to the middle and lower income brackets, since payroll taxes weren’t cut. If fact, they were raised to pay for rising social security and Medicare benefits, worsening the growing inequality. Even then, President Reagan had to raise taxes 18 times when he realized the huge deficit it created.

The anti-government crusade continued with the $5.7 trillion in debt created by GW Bush’s tax cuts and unpaid wars, according to the non-partisan Center for Budget and Policy Priorities. More than 50 percent of the tax benefits in fact went to the wealthiest one percent—for capital gains and dividends, a lower maximum income tax rate, accelerated depreciation for companies, and the like.

The resultant increase in the deficit has endangered both social security and Medicare benefits, which mainly support the elderly as well as the lowest wage earners. The result is almost inevitable—the expectation of a ‘new normal’ growth rate with permanently higher unemployment, lower wages for average workers, and reduced social security and Medicare benefits.

In lowering our expectations, ultra-conservatives are having their way, in other words. And it will result in a greater social divide than ever—between the Have and Have-Not states, the educated and less educated, which will create a larger and more permanent Under Class.

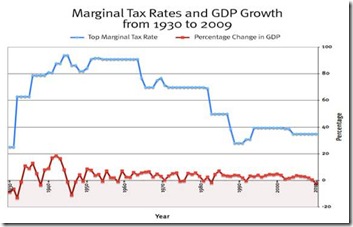

But it doesn’t have to be that way. We could go back to a more progressive tax system that nurtures higher growth rates by closing the tax loopholes and raising the maximum income tax bracket back to 39 percent of the Clinton era. We know that President Clinton did it while cutting spending that resulted in budget surpluses from 1997 to 2001. In fact, a wonderful graph by Eliot Spitzer in Slate of the history of marginal tax rates shows that the GDP growth rate has been basically stagnant since 1980 with the decline in marginal income tax rates.

We can also cut entitlement expenses by continuing to implement the new Patient Protection and Affordable Care Act (PPACA, Public Law 111-148); and, following that, the Health Care and Education Reconciliation Act of 2010 (H.R. 4872), which made a number of changes to provisions of PPACA along with significant changes to the federal postsecondary education programs, will both improve preventative care and lower costs, as reported by the Congressional Budget Office.

In fact, allowing the GW Bush cuts to expire in 2012 would halve the deficit in 10 years, according to the Congressional Budget Office (CBO). While continuing the tax cuts for the 2011-2020 time period would add $3.3 trillion to the national debt, comprising $2.65 trillion in foregone tax revenue plus another $0.66 trillion for interest and debt service costs.

But until Republicans realize that shrinking government without policies that redistribute wealth back to the wage and salary earners who produce and spend it, very little growth will happen. And that shrinks the living standard for all of us. It shows policies which hide behind shrinking government really destroy wealth—and taking away the wealth of some takes away better economic growth and prosperity for all.

Harlan Green © 2011

No comments:

Post a Comment