Financial FAQs

We are having the wrong budget debate. Washington is not talking about paying down the federal debt, which now totals some $9.5 trillion held publicly. Budget deficits are created when revenues don’t equal spending. So when the focus is only on cutting taxes and public spending by downsizing government and so public services—such as in protecting our health, the financial markets, the environment, education—and not increasing those revenues, then it doesn’t cure our budget problem. In fact, it just aggravates the problem, while putting more people into poverty.

The best example is the last time we had a balanced budget—in 1999. It was a time when Congress agreed to the Pay-as-you-go rules. Spending increases had to be balanced with revenue increases. And only when our economy was booming—21 million jobs were created during those years, and the highest income tax bracket was raised to 39 percent—were there enough revenues to pay down the debt. The debt that had been built during the 1980s by cutting taxes didn’t disappear by cutting spending, in other words.

This is obvious to the average household. Consumers know that, unless they pay down their debts the debt doesn’t go away. They are careful not to accumulate more debts, of course. But the real problem is how to shrink the debt by putting more of their income into paying it down, while spending less. Shrinking their incomes to pay down the debt doesn’t work, period.

Governments have had to do the same. Our largest public debt as a percentage of the economy was the 120 percent of GDP accumulated from WWII. It took the massive spurt in growth during the 1950s and 60s to pay it down to below 40 percent of GDP in the 1970s. It was accompanied by massive public spending on infrastructure (e.g., highways, education) that raised everyone’s standard of living—not just the wealthiest.

This was paid for by taxing the wealthiest among us, whose top tax bracket was 91 percent under Republican President Dwight Eisenhower. And by raising everyone’s standard of living, our economy prospered since prosperous consumers meant more demand for goods and services, hence more jobs.

The 1920s were a similar period of inequality as we have today. The top 1 percent income bracket controlled 23.5 percent of national income as now, when there was no unemployment insurance, deposit insurance, and social security to protect the savings of average consumers and the elderly.

Roosevelt’s New Deal corrected that problem and brought on the post-war prosperity by guaranteeing that most Americans could prosper.

As of January 2011, foreigners owned $4.45 trillion of U.S. debt, or approximately 47 percent of the debt held by the public of $9.49 trillion and 32 percent of the total debt of $14.1 trillion (that includes the social security trust fund). The largest holders were the central banks of China ($1.1 trillion) and Japan ($885 billion). The share held by foreign governments has grown over time, rising from 25 percent of the public debt in 2007 before the Great Recession.

One would think, therefore, that paying down debt should be the first priority of any U.S. administration. But the debate has been skewed by those who profit most from cutting taxes, without growing public revenues—Big Business, Wall Street, and their investors who have corralled 40 percent of the wealth of this country. It is obvious they care little about the debt, since they advocate cutting public spending without raising revenues needed to pay down the debt.

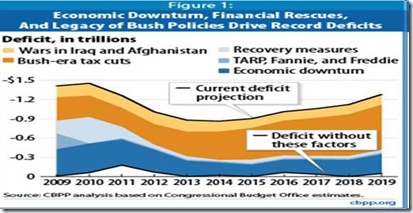

We know how the current federal debt was accumulated since 2000. The largest percentage—more than $3 trillion—came from the Bush tax cuts of 2001 and 2003, which reduced not only the highest income tax brackets from the Clinton era 39 percent to 35 percent, but reduced long term capital gains and dividend taxes that mainly benefit the wealthy to a maximum 15 percent. Then the Iraq and Afghanistan wars cost another $1 trillion of borrowed money. The Great Recession accounts for most of the rest of the deficit. So all this happened while reducing the income needed to pay for that debt.

Curing the budget deficit is really a common sense matter. We must grow our economy by boosting everyone’s income, in other words, not just that of the wealthiest, while holding our expenses. We did it in the 1990s. That can only happen with increased job formation, and a fairer tax code. Just cutting taxes that funnels money into the pockets of the wealthy, but cuts funding for research and development, programs that develop new talent by nurturing educational opportunities, and a regulatory environment that prevents excessive risk-taking by Wall Street, can only lead to more debt, not less.

Harlan Green © 2011

No comments:

Post a Comment