Popular Economics Weekly

What policies that will do most to bring back jobs is being sidelined by the budget debate. Everyone agrees boosting aggregate demand; the sum of consumer spending, foreign and domestic investment, exports and government stimulus—is the way to create jobs. The argument is over whether the private or public sectors are better at it.

That shouldn’t be the debate. Given this is the worst downturn since the Great Depression, all stimulus cylinders must be firing. That increases both corporate profits—though already at record levels—and the revenues needed to pay down debt.

Here is why. As Calculated Risk reported recently, there are currently 130.738 million payroll jobs in the U.S. (as of March 2011). There were 130.781 million payroll jobs in January 2000. So there was no increase in total payroll jobs in over eleven years. Only in January 2010 did the number of ‘Hires’ and ‘Job openings’ again begin to rise above the number of ‘Layoffs’, according to the Labor Department’s latest Job Openings and Labor Turnover (JOLTs) survey.

And the median household income in constant dollars was $49,777 in 2009. That is barely above the $49,309 in 1997, and below the $51,100 in 1998. “Just a reminder that many Americans have been struggling for a decade or more. The aughts were a lost decade for most Americans,” said Econoday.

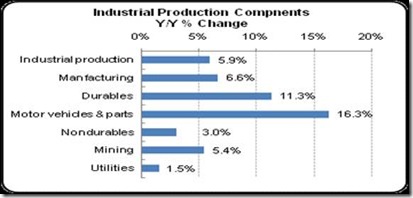

What are the 80 percent of consumers who are fully employed buying? Mostly durable goods, like cars. Manufacturing is leading us out of the recession, in part because of the weak dollar that has goosed exports. Econoday tells us over the past 12 months industrial production has been strong with a 5.9 percent gain and with manufacturing up a notable 6.6 percent. Manufacturing has been led by durables (up 11.3 percent) with motor vehicles being particularly robust (up 16.3 percent).

So we are in bit of a Catch-22 situation. The weak dollar exchange rate is also worrying deficit hawks, since they believe it endangers foreign investors (mostly the Chinese and Japanese) from investing their excess dollars in the U.S., maybe causing interest rates to rise abruptly. Standard & Poor’s rating agency has put the U.S. on what is essentially a credit watch, saying it didn’t believe Democrats and Republicans would be able to agree on how to reduce the deficit by election year 2012.

Yet the only thing that does reduce budget deficits is growth. Great Britain has proved that with its conservative government that was elected on a drastic spending cut platform. The result is their economic growth has slowed drastically.

The New York Times reported on first year results of Britain’s austerity program in a recent article. “…one year into its own controversial austerity program to plug a gaping fiscal hole, the future is now. And for the moment, the early returns are less than promising,” said the NYTimes. “Retail sales plunged 3.5 percent in March, the sharpest monthly downturn in Britain in 15 years. And a new report by the Center for Economic and Business Research, an independent research group based here, forecasts that real household income will fall by 2 percent this year. That would make Britain’s income squeeze the worst for two consecutive years since the 1930s.” So many British economists now believe they are in danger of a double-dip recession.

This has to be a case of ignorance not being a blissful state. President Roosevelt attempted to balance the budget in 1937 after 4 years of recovery from the first Depression, but it plunged the U.S. into its second Depression, which wasn’t cured until WWII increased government spending (and borrowing) to the tune of 120 percent of GDP. It was only surging post-war growth of the 50s and 60s that brought debt down to 40 percent of GDP where it essentially remained until 1980, when President Reagan and the Republicans again attempted to balance the budget on the back of drastic tax cuts, lowering the top income tax bracket to 39 percent from 48 percent. This resulted in two back-to-back recessions in 1982-83.

So, when one side of the budget debate takes tax increases but not tax cuts off the table, there are two results. Tax cuts only provide limited stimulus, as the Bush tax cuts proved—they increased the deficits from essentially $0 in 2000 to more the $2 trillion in 2008, in spite of low unemployment and inflation. A failure to pay down the budget deficit and invest in needed infrastructure, education and research projects that increase productivity, damages both our economic growth and competitive position in the world.

“Every U.S. policymaker should therefore wake up every morning and remind themselves of the following,” says Econoday. “There are currently 7.25 million fewer payroll jobs than before the recession started in 2007, with 13.5 million Americans currently unemployed. Another 8.4 million are working part time for economic reasons, and about 4 million more workers have left the labor force. Of those unemployed, 6.1 million have been unemployed for six months or more.

But that won’t happen if we continue to squabble over ideologies, rather than focus on how to create more jobs.

Harlan Green © 2011

No comments:

Post a Comment