No one wants to talk about the elephant in the room during this election season, wealth redistribution. Yet that is guiding policy makers on both sides of the political spectrum. Democrats are trying to restore middle class incomes by preserving the so-called middle class Bush II tax cuts for those incomes below $250,000, for example. Repubs meanwhile want to preserve all of the tax cuts, including for the wealthiest.

That is just one example of the mentality of both sides. In their minds, this economy is a zero-sum game, and so why discuss it? It is an I Win-You Lose world, in other words, which is fueled by the fear that many will miss out on a barely recovering economy. Yet that doesn’t have to be so.

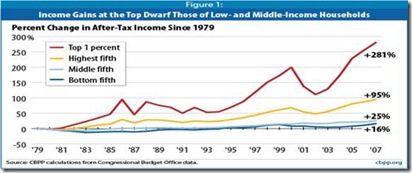

Wealth redistribution should be discussed, since most income segments have seen a decline in their real (after inflation) incomes since the 1970s—except for the top one percent income bracket. And we cannot afford such growing income inequality, now the greatest since 1929, since economists are discovering that it was a main cause of the 2007-09 Great Recession as well.

The largest share of the nation’s income now goes to the wealthiest households. For example, according to the Center on Budget Policy and Priorities, between 1979 and 2007:

- The top 1 percent’s share of the nation’s total after-tax household income more than doubled, from 7.5 percent to 17.1 percent.

- The share of income going to the middle three-fifths (or 60 percent) of households shrank from 51.1 percent to 43.5 percent.

- The share going to the bottom fifth of households declined from 6.8 percent to 4.9 percent.

- The share going to the bottom four-fifths (80 percent) of the population declined from 58 percent to 48 percent.

Yet overall, the long term, historical personal income rate of increase is 5.6 percent per year. So the I win-You lose mentality is a fallacious (and even specious) economic argument. In fact, modern economic theory says just the opposite—when income is more fairly distributed via progressive taxation and other wealth equalizing policies (including universal health care).

Put more money into consumers’ pockets (i.e., the lower and middle class income brackets that spend the most), and we all win. Mainstream economic theory states that it creates greater aggregate demand for all—i.e., demand for not only more goods and services, but investments that create jobs. And demand can be created from either the public or private sector.

This win-win policy is a well-known truth most explicitly formulated by John Maynard Keynes, the economic theorist most reviled by conservatives who oppose most forms of government spending—except for defense, of course.

Conservatives don’t like social security or universal health care either, of course, because conservatives wish to preserve their wealth—won over many years of hard fought battles with unions and progressive liberals under President Reagan’s “government is the problem” mantra. And with Ayn Rand disciple Alan Greenspan running the Federal Reserve during this time, the floodgates were opened to allow the so-called ‘free market’ rewards to flow to those most able to exploit its opportunities.

Of course the call to more individual freedom that Ayn Rand espoused has to be enabled by smaller government, which also meant lesser regulation. President Reagan’s mantra is good for a world of entrepreneurs in a Darwinian dog-eat-dog world of global competition, in which the lowest wage earning companies and countries with least environmental safeguards end up being the producers, while the rest of us become consumers.

The problem with producing less and consuming more, however, is that consumers also have to make a decent living if they are to spend more, which is impossible with declining wage and working standards. Only those at the top—the most educated and entrepreneurial, in a word—are able to exploit those opportunities. Clinton-era Labor Secretary Robert Reich has explored this in his, “The Future of Success”, and subsequent books.

There is another disadvantage to such growing inequality, as well. It leads to more severe recessions, as we have said. The greatest periods of income inequality, 1928-9 and 2007-08, also led us into the severest economic downturns—the Great Depression and Great Recession. There is no good economic or political reason for such inequality to continue, if we want more sustainable—and predictable--growth.

Harlan Green © 2010

No comments:

Post a Comment